In the dynamic landscape of Australian business securing the right financing can be a pivotal factor in unlocking a small to medium enterprise's potential for growth and success However credit scores often serve as a crucial benchmark for lenders influencing the terms and availability of loans and posing unique challenges for many SMEs At fundU we understand that not every business has a perfect credit score and we pride ourselves on providing flexible lending solutions even for those with less than ideal credit histories This piece will delve into how credit scores impact financing options exploring interest rates loan terms and access to credit while highlighting how fundU's innovative approach including options like caveat loans and privately funded business loans empowers Australian SMEs to thrive despite credit challenges Whether you're a business owner or a finance broker understanding the nuances of credit assessments can help you navigate the complexities of securing the right funding.

Yes businesses indeed have credit scores Much like personal credit scores a business credit score is a numerical representation of a company's creditworthiness This score helps lenders assess the risk associated with providing financing to the business Typically a business credit score ranges from to in Australia with higher scores indicating lower risk Factors influencing a business credit score include the company's credit history outstanding debts repayment habits and the length of its credit history Understanding your business credit score is crucial because it can significantly impact your ability to secure loans negotiate favorable terms and access lower interest rates For SMEs maintaining a good credit score can open doors to better financing options while a lower score might necessitate exploring alternative solutions like those offered by fundU.

A good business credit score is generally considered to be one that demonstrates low risk to lenders In Australia a score above is typically seen as favorable indicating that a business has a strong credit history and is likely to repay debts on time This score can lead to better financing terms such as lower interest rates and more flexible loan conditions However it's important to note that what constitutes a "good" score can vary between lenders as each may have different criteria and risk appetites For small to medium enterprises SMEs looking to improve their credit score timely repayments maintaining low credit utilization and regularly checking for inaccuracies in their credit report can be beneficial At fundU we understand that not all businesses have perfect scores That's why we offer tailored lending solutions to help businesses secure financing even if their credit score isn't ideal.

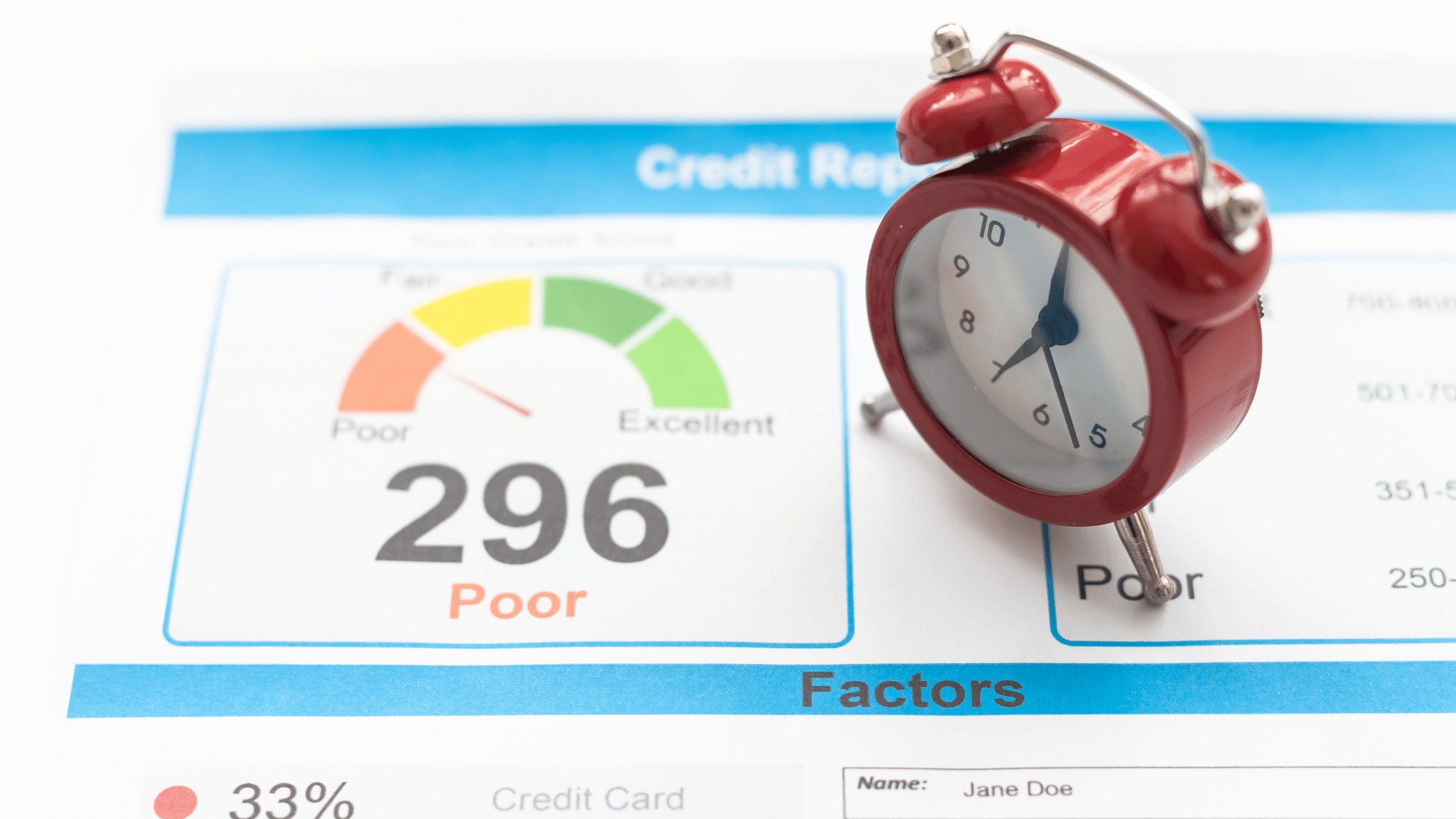

Credit scores play a pivotal role in determining the interest rates offered to businesses seeking financing Generally a higher credit score translates to lower interest rates as it signifies lower risk to the lender Conversely a lower credit score often results in higher interest rates reflecting the increased risk perceived by the lender For Australian SMEs this can significantly impact the overall cost of borrowing and the feasibility of loan repayment Businesses with strong credit scores can benefit from more competitive rates which can lead to substantial savings over the loan term On the other hand those with poor credit scores might face higher rates that could strain their financial resources At fundU we recognize these challenges and strive to provide flexible lending solutions that don't hinge solely on credit scores ensuring that even businesses with less than perfect credit can access the funds they need at reasonable rates.

Credit scores significantly influence the terms of loans available to businesses Lenders often use credit scores to gauge the risk associated with a loan affecting not only the interest rates but also the duration and conditions of the loan Businesses with high credit scores are generally perceived as lower risk which may result in more favorable terms such as longer repayment periods and fewer collateral requirements Conversely those with lower scores might face shorter loan terms and more stringent conditions as lenders attempt to mitigate perceived risks For Australian SMEs understanding this dynamic is crucial as it impacts the affordability and sustainability of borrowing At fundU we aim to bridge the gap for businesses with less than ideal credit scores by offering flexible loan structures This approach ensures that businesses can still secure the necessary funding without being unduly burdened by restrictive loan terms enabling them to focus on growth and success

Australian SMEs often encounter unique hurdles when seeking financing stemming from the distinct economic environment and regulatory landscape they operate within One significant challenge is the stringent lending criteria imposed by traditional financial institutions which can be particularly daunting for newer businesses or those with fluctuating revenues Additionally SMEs may face difficulties in providing the necessary collateral required by many lenders further complicating access to financing The variability in credit scores amongst SMEs also poses a hurdle as lower scores can limit options and increase borrowing costs Furthermore economic volatility and market uncertainties can exacerbate these challenges making it difficult for businesses to forecast and plan for future financial needs At fundU we recognize these hurdles and offer alternative lending solutions designed to meet the unique needs of SMEs By providing options like caveat loans and privately funded business loans we aim to empower businesses to overcome these challenges and secure the funding they need to thrive.

Finance brokers play a crucial role in navigating the complex landscape of financing options available to Australian SMEs They act as intermediaries between businesses and lenders leveraging their expertise to identify the most suitable financial products tailored to a businessʼs unique needs and circumstances Brokers are

particularly valuable for SMEs facing challenges like low credit scores or insufficient collateral as they possess in depth knowledge of alternative lending solutions that might not be immediately apparent to business owners Their ability to negotiate terms and conditions can also help SMEs secure more favorable loan arrangements potentially saving significant costs over time Moreover finance brokers provide ongoing support and advice helping businesses adapt to changing financial circumstances and plan for future growth At fundU we collaborate with finance brokers to enhance our clients' access to diverse financing options ensuring that even those facing credit challenges can find viable pathways to secure essential funding.

At fundU we recognize that not all businesses fit the mold required by traditional lenders particularly when it comes to credit scores and collateral requirements To address this we offer a range of alternative lending options tailored to meet the diverse needs of Australian SMEs Our solutions include caveat loans which allow businesses to leverage property equity without the lengthy approval processes typical of conventional loans We also provide privately funded business loans that offer more flexible terms and quicker access to funds This flexibility can be crucial for businesses needing immediate capital to seize opportunities or manage cash flow Additionally our short term loans are designed to bridge financial gaps without the long term commitment making them ideal for businesses facing temporary financial hurdles By offering these alternatives fundU empowers SMEs with less than perfect credit scores to access the funding they need to grow and succeed even in challenging financial circumstances.

For businesses grappling with low credit scores securing financing through traditional means can be a formidable challenge At fundU we offer tailored lending solutions specifically designed to accommodate businesses that may not meet conventional credit criteria Our bad credit business loans are structured to provide access to necessary capital without the stringent requirements that typically accompany traditional loans By focusing on the potential and unique circumstances of each business rather than just their credit score we can offer solutions that enable growth and stability These loans often come with flexible terms and conditions allowing businesses to manage repayments more effectively This approach ensures that despite a low credit score businesses can still secure the funding necessary to enhance operations invest in growth opportunities or navigate financial rough patches Our goal is to support SMEs in overcoming credit challenges and achieving long term success.

Navigating credit challenges requires a strategic approach to financing that aligns with a business's unique needs and circumstances At fundU we believe in crafting tailored financing strategies that take into account the specific financial goals and constraints of each SME This involves a comprehensive assessment of the business's financial health cash flow requirements and long term objectives By working closely with business owners we develop personalized solutions that might include a mix of loan products such as bad credit business loans caveat loans or short term financing options This customized approach ensures that businesses are not only able to secure the necessary funds but also manage their financial commitments sustainably Our tailored strategies are designed to provide flexibility and support enabling businesses to adapt to changing market conditions and capitalize on growth opportunities Ultimately fundU aims to empower SMEs to overcome credit obstacles and achieve their vision of success.

Access to financing can be a critical factor in seizing growth opportunities especially for SMEs navigating credit challenges When traditional lenders are hesitant due to low credit scores businesses might miss out on pivotal moments that could drive expansion and increase market competitiveness At fundU we understand the importance of timely financial support to capitalize on these opportunities Our lending solutions such as caveat loans and privately funded business loans are designed to provide quick and flexible access to capital This agility enables businesses to invest in new projects expand operations or enter new markets regardless of their credit score By offering financial products that don't solely depend on credit ratings we help businesses overcome barriers and pursue their growth strategies with confidence Our goal is to ensure SMEs are well equipped to leverage opportunities as they arise fostering long term success and resilience in a competitive landscape.